change in working capital formula dcf

Since the change in working capital is positive you add it back to Free Cash Flow. Change in Net Working Capital 12000 7000.

How To Use Discounted Cash Flow For Real Estate Valuation

1173 x 1772 126356 x 1772 1361 x 1772 146618 x 1772 157937 x 1772 170130.

. Answer 1 of 6. If a transaction increases current assets and. The changes in working capital are discounted using the WCSales ratio working capital over sales which in this case is 80 8510 094.

Change in Net Working Capital Net Working Capital for Current Period Net Working Capital for Previous Period. Determine whether the cash flow will increase or decrease based on the needs of the business. Thats why the formula is written as - change in working capital.

The net change in working capital relates to timing differences between recording revenue and receiving it in cash and recording expenses and paying for them in cash. Increasing vs Decreasing Change in NWC. The change in net working capital formula is given as N E B where E is ending net working capital and B is beginning NWC.

Change in a net working capital change in. The working capital formula is. It means the change in current assets minus the change in current liabilities.

Net Working Capital Current Assets less cash Current Liabilities less debt or NWC Accounts Receivable Inventory Accounts Payable. The second file includes other working capital items and has a bit more detail In evaluating stable working capital both files demonstrate that you can use the following formula in the terminal period for stable working capital. The answer is yes non-cash working capital can absolutely be negative.

Some firms have negative non-cash working capital. Non-cash working capital 1904 335 - 1067 - 702 470 million. The first formula above is the broadest as it includes all accounts the second formula is more narrow.

Stable WC Change WCEBITDA EBITDA t terminal growth 1terminal growth. Change in Net Working Capital 5000. The entire intuition behind CA-CL is to arrive at how cash has changed over the period increases in CA use of cash increase in CL source of cash--in that sense you would use non-cash CA - CL to get to FCF to do your DCF.

Changes in working capital are reflected in a firms cash flow statement. Now we can apply the formula. Finally the Change in Working as calculated manually on the Balance Sheet will rarely if ever match the figure reported by the company on its Cash Flow Statement.

In Table 1010 we report on the non-cash working capital at the end of the previous year and the total revenues in each year. The non-cash working capital for the Gap in January 2001 can be estimated. Change in Net Working Capital NWC Prior Period NWC Current Period NWC As a sanity check you should confirm that if the NWC is growing year-over-year the change should be reflected as a negative cash outflow and the change would be positive cash inflow if the NWC is declining year-over-year.

Free cash flow decreases. Change in Inventory 9497 8992 505. As discussed above as long as normal working capital is positive then negative NCWC does not signify a negative impact on the business.

Heres an example for Target. Here is an example of the calculations. Net change in Working Capital 1033 850 183 million cash outflow Analysis of the Changes in Net Working Capital.

Under ordinary operating conditions many if not most companies have positive working capital current assets exceed current liabilities so forecasted increases in revenues require additional working capital investments and free cash flow is reduced all else held constant. The changes in working capital are discounted using the wcsales ratio working capital over sales which in this case is 80 8510 094. However at 3 growth.

Working capital increases. Change in Net Working Capital is calculated using the formula given below. Here are some examples of how cash and working capital can be impacted.

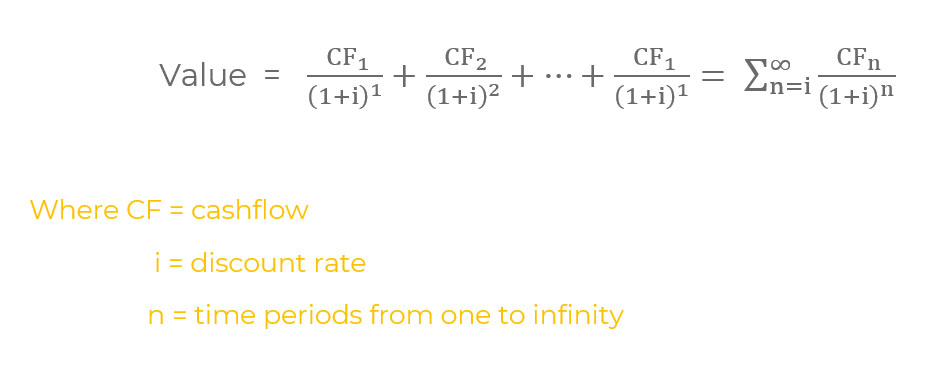

Valuation depends upon whether the DCF is valuing cash flows to operating assets or cash flows to. A far better estimate of non-cash working capital needs looking forward can be estimated by looking at non-cash working capital as a proportion of revenues. The goal is to.

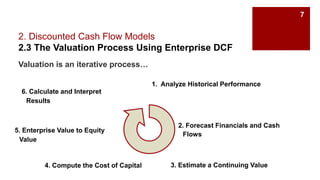

First we have to address a primary assumption on what the DCF is measuring. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth will also remain at the same level perpetually which is definitely not the case when the growth rate drops to 3 at 93 growth changes in working capital is 118k. Working Capital The Gap.

It is a measure of a companys short-term liquidity and is important for performing financial analysis financial modeling. The first formula above is the broadest as it includes all accounts the second formula is more narrow and the last formula is the most narrow as it only includes three accounts. Change in Net Working Capital 5000.

Change in Working capital does mean actual change in value year over year ie. Changes in non-cash working capital from year to year tend to be volatile. Calculate the change in working capital.

Once this is established your question can be answered. Change In Net Working Capital Dcf change comin The change of accounts required to perform the business such as changes in receivables inventory and payables which affect the cash flow statement. Working capital changes can make cash flows lumpy and simply putting last years or the trailing twelve month free cash flow number into a DCF model could produce wild swings.

On the contrary it can mean that the company has leftover cash to pay for short- and long-term obligations reinvest in the company. Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Add or subtract the amount.

If youre asking whether you include cash in the CA to get to change in net working capital the answer is no.

How To Use Discounted Cash Flow For Real Estate Valuation

Discounted Cash Flow Analysis Street Of Walls

10 Of 14 Ch 10 Change In Net Working Capital Nwc Explained Youtube

Discounted Cash Flow Analysis Street Of Walls

Calculate The Change In Working Capital And Free Cash Flow

Discounted Cash Flow Analysis Street Of Walls

Cash Flow Statement Cfs Structure And Format Excel Template

Discounted Cash Flow Model Dfc Formula And Example

How To Calculate Fcfe From Net Income Overview Formula Example

Working Capital And Non Cash Working Capital Youtube

How To Use Discounted Cash Flow For Real Estate Valuation

Chapter 4 On Valuation And Reporting In Organization

How To Use Discounted Cash Flow For Real Estate Valuation

Discounted Cash Flow Analysis Street Of Walls

Training Modular Financial Modeling Ii Dcf Valuations Equity Dcf Valuation Valuation Dates Cash Flow Timing Modano

Discounted Cash Flow Analysis Street Of Walls

How To Use Discounted Cash Flow For Real Estate Valuation